Equip Your Service: Bagley Risk Management Insights

Wiki Article

How Animals Risk Security (LRP) Insurance Can Protect Your Animals Investment

In the world of livestock financial investments, mitigating risks is vital to guaranteeing monetary security and growth. Animals Risk Security (LRP) insurance policy stands as a reputable guard against the unforeseeable nature of the marketplace, providing a critical method to guarding your assets. By delving right into the intricacies of LRP insurance coverage and its complex benefits, animals manufacturers can fortify their investments with a layer of protection that goes beyond market variations. As we explore the realm of LRP insurance coverage, its duty in securing livestock investments ends up being significantly apparent, guaranteeing a path in the direction of lasting monetary strength in an unpredictable industry.

Recognizing Livestock Danger Security (LRP) Insurance

Recognizing Livestock Risk Defense (LRP) Insurance coverage is important for animals manufacturers seeking to reduce economic threats connected with rate changes. LRP is a federally subsidized insurance coverage product developed to protect producers against a decline in market rates. By offering protection for market value declines, LRP helps producers secure a flooring cost for their livestock, making certain a minimal level of profits no matter market changes.One key facet of LRP is its versatility, allowing manufacturers to personalize protection levels and plan lengths to match their details needs. Manufacturers can choose the variety of head, weight array, coverage cost, and insurance coverage period that line up with their manufacturing objectives and run the risk of resistance. Recognizing these customizable choices is essential for manufacturers to properly manage their cost danger direct exposure.

Moreover, LRP is offered for different animals types, including livestock, swine, and lamb, making it a versatile threat management device for livestock manufacturers throughout different sectors. Bagley Risk Management. By familiarizing themselves with the complexities of LRP, producers can make educated choices to secure their financial investments and make sure monetary stability despite market uncertainties

Benefits of LRP Insurance Coverage for Animals Producers

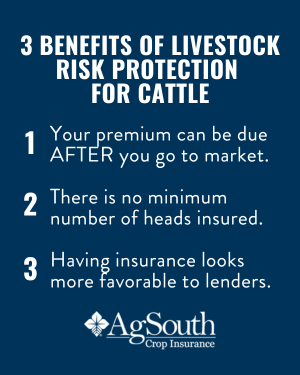

Animals manufacturers leveraging Animals Risk Protection (LRP) Insurance coverage obtain a strategic benefit in securing their financial investments from price volatility and protecting a stable economic footing amidst market unpredictabilities. By establishing a flooring on the price of their animals, producers can mitigate the danger of significant economic losses in the event of market downturns.

In Addition, LRP Insurance offers producers with tranquility of mind. On the whole, the benefits of LRP Insurance for livestock manufacturers are considerable, supplying a valuable tool for managing risk and ensuring monetary safety in an unforeseeable market atmosphere.

Exactly How LRP Insurance Coverage Mitigates Market Threats

Alleviating market dangers, Livestock Threat Security (LRP) Insurance gives animals producers with a dependable guard versus price volatility and financial unpredictabilities. By supplying security versus unexpected cost drops, LRP Insurance aids producers safeguard their investments and keep financial security in the face of market variations. This sort of insurance policy allows animals producers to secure a rate for their animals at the start of the policy period, making certain a minimum rate degree regardless of market adjustments.

Steps to Safeguard Your Animals Financial Investment With LRP

In the realm of farming threat management, executing Animals Threat Protection (LRP) Insurance coverage includes a critical process to secure investments against market changes and unpredictabilities. To safeguard your animals investment efficiently with LRP, the very that site first step is to examine the details threats your procedure faces, such as price volatility or unforeseen weather condition occasions. Next off, it is vital to study and select a respectable insurance policy carrier that offers LRP plans tailored to your animals and business demands.Long-Term Financial Security With LRP Insurance Policy

Making certain sustaining economic security via the use of Livestock Risk Protection (LRP) Insurance is a sensible lasting approach for farming manufacturers. By integrating LRP Insurance coverage into their danger management plans, farmers can guard their animals investments versus unexpected market changes and adverse events that can endanger their monetary wellness in time.One key advantage of LRP Insurance policy for long-lasting financial protection is the peace of mind it offers. With a reputable insurance coverage in position, farmers can mitigate the monetary risks linked with unstable market problems and unforeseen losses due to aspects such as disease episodes or natural calamities - Bagley Risk Management. This stability permits producers to concentrate on the day-to-day procedures of their animals organization without continuous bother with potential monetary setbacks

Additionally, LRP Insurance supplies a structured technique to taking care of danger over the lengthy term. By setting certain coverage levels and picking suitable recommendation periods, farmers can tailor their insurance policy prepares to line up with their financial objectives and take the chance of tolerance, making certain a lasting and safe and secure future for their animals operations. Finally, buying LRP Insurance policy is a proactive technique for farming manufacturers to attain lasting financial safety and shield their incomes.

Final Thought

In conclusion, Livestock Danger Defense (LRP) Insurance policy is a valuable tool for livestock producers to alleviate market threats and secure their investments. By understanding the benefits of LRP insurance coverage and taking steps to execute it, manufacturers can accomplish lasting economic safety and security for their procedures. LRP Discover More Here insurance policy provides a safeguard against cost changes and guarantees a degree of security in an uncertain market setting. It is a smart option for securing animals financial investments.

Report this wiki page